John Cassim

Lake Harvest, one of Zimbabwe’s largest fish producers, is facing imminent closure if the Zimbabwe Revenue Authority (ZIMRA) garnishes its bank accounts due to unpaid taxes, ConserveZim has learned.

While the exact amount owed remains unspecified, sources within Lake Harvest indicate that the imposition of a 15% Value Added Tax (VAT) has significantly worsened the financial situation for most fish-producing companies, including Lake Harvest.

Lake Harvest was already facing some financial challenges but the coming of this VAT made it worse resulting in the entity failing to pay ZIMRA on time.

In a letter dated April 3rd from ZIMRA, Lake Harvest had initially requested to pay the arrears in instalments but has since failed to do so due to severe financial constraints.

The ZIMRA letter states: “Reference is made to the above subject matter as per your letter dated 18 March 2025. The payment plan has been cancelled due to your non-compliance, specifically your failure to pay the first instalment which was due on 31 March 2025.

You are now requested to pay the full amount immediately. Failure to pay the total tax debt will result in the reinstatement of the garnishee and other enforcement actions as provided for under the law, without further notice.”

Meanwhile, Lake Harvest General Manager, Permit Shava, has appealed for an exemption from the 15% VAT that was imposed in January 2024 on all fish and meat products. This VAT was subsequently withdrawn on meat products but remains in effect for fish.

Speaking to ConserveZim, Permit Shava said, “We strongly appeal to the government to review the VAT policy on fish sales. The introduction of VAT on fish (effective January 1, 2024) has led to a significant increase in prices, making fish less affordable for consumers. As a result, sales have dropped by 50%, with consumers turning to cheaper alternatives.

Previously, fish was VAT-exempt, allowing it to remain competitively priced and accessible. However, the current VAT structure has placed Lake Harvest and other commercial fish farmers in a severe financial crisis, with cash flow constraints threatening business viability.”

A Lake Harvest boat carrying feed to the company’s breeders in Lake Kariba

VALUE ADDED TAX

In January 2024, the government imposed a 15% VAT on meat and fish products, a move that was met with significant public outcry.

This imposition meant that all meat and fish produced in Zimbabwe became less competitive, with prices rising above those of similar products in the region.

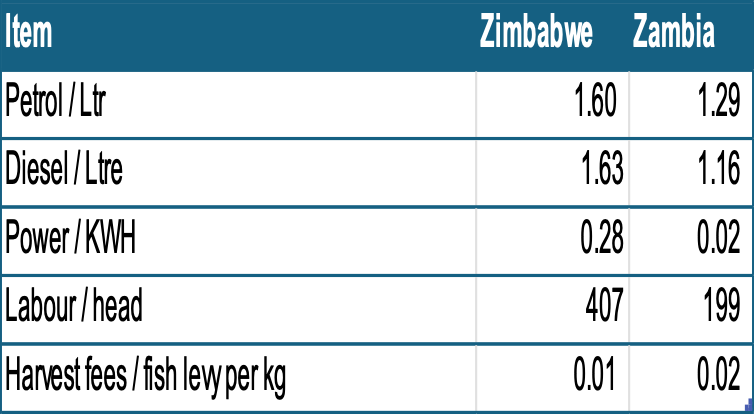

Regarding fish, Zambia reportedly produces it at a significantly lower cost than the Zimbabwean market.

Consequently, consumers began purchasing more imported meat and fish instead of local products.

Fish produced in Zimbabwe now costs US$3.51 per kilogram, compared to US$2.10 per kilogram in Zambia.

“I think in terms of equity and fairness, it would be good if the Minister of Finance treated all these products similarly because they are all basic forms of protein. Singling out fish for VAT while exempting other meats seems very unfair and considerably disadvantages fish consumers.

In any event, eating fish is not the primary protein choice when considering the preference scale for meat products in Zimbabwe. However, we are working hard to ensure that fish production grows and becomes as popular as beef or chicken,” said Mr. Garikai Munatsirei, Chairperson of the Zimbabwe Fish Producers Association.

Mr. Munatsirei made these remarks following the recent exemption of all other meat products from the 15% VAT that was initially imposed in January 2024, leaving fish as the sole exception.

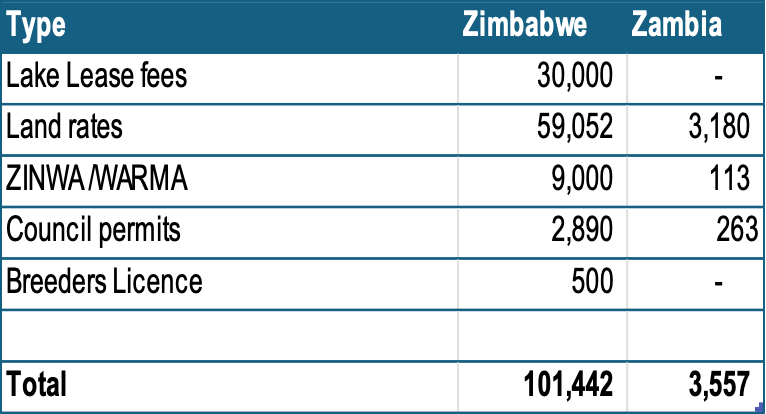

On top of the VAT, Zimbabwean fish producers face substantial cost disadvantages compared to regional competitors like Zambia.

Regulatory fees in Zimbabwe for a producer like Lake Harvest, exceed US$100,000 annually, significantly increasing operational costs.

A table showing the value of all the levies Lake Harvest pay annually

APPEAL FOR FISH VAT EXEMPTION

Following numerous meetings and correspondences between stakeholders in the fish industry and the Ministry of Lands, Agriculture, Fisheries, Water and Rural Development, the latter submitted a request for fish to be exempted from VAT.

The Ministry’s letter to the Ministry of Finance and Economic Development highlighted the vulnerability of Zimbabwe’s livestock due to the El Nino drought: “Regarding Zimbabwe’s livestock, 40% of the 5.7 million beef herd, valued at USD 665 million, is at elevated risk of El Nino drought-induced cattle deaths due to a shortage of pasture and water, compounded by diseases from August through to November 2024.

The producer prices of livestock for slaughter – beef cattle, goats, pigs, broiler chicken – have fallen over the first six months of the year compared to 2023 by 40% (beef), 15% (goats), 25% (pigs), and 20% (broiler meat).”

In the same submission, the Ministry of Lands also requested the removal of various forms of tax as a drought mitigation measure.

“As a drought mitigation relief measure, it is hereby directed that all government levies and taxes on livestock be suspended from 15 July 2024 to 15 December 2024, as the government’s further contribution to assist farmers in drought-prone districts to get a fair value for their livestock,” the submission stated.

The ministry requested the suspension of taxes listed in Appendix 1b, Appendix 11, Appendix 11a, Appendix 11b, Appendix 111c, and Appendix 1V.

Appendix 1V specifically includes VAT on locally farmed fish – tilapia or trout – whether whole, gutted, or filleted, fresh, chilled, or frozen, and on dried freshwater fish (dried and salted kapenta, dried or smoked freshwater bream).

On September 19, 2024, during a Fish and Aquaculture Indaba held at the Zimbabwe Agriculture Showgrounds, Dr. Pious Makaya, Chief Director of the Department of Veterinary Services, announced that the Ministry of Finance had agreed to scrap the 15% VAT on all meat and fish products.

“We have already scrapped VAT on live animals; it is effective right now as I speak. However, we want to scrap more VAT imposed on animal-derived foods, which also includes fish products. To do that, we need the involvement of three ministries: the Ministry of Commerce and Industry, the Ministry of Lands and Agriculture, and the Ministry of Finance. Only then can we gazette that officially,” Dr. Makaya said.

That announcement marked the last time fish producers heard about the VAT exemption.

BUREAUCRACY AND BOTTLENECKS

Since then, players in the fish industry have been appealing to the Minister of Lands and Agriculture, Dr. Anxious Masuka, as well as the Permanent Secretary, Professor Obert Jiri, to have the VAT removed.

Lake Harvest, like other affected businesses, also wrote numerous letters to both offices, receiving the same response.

“It’s a matter still under discussion; we are still awaiting a response,” Professor Obert Jiri told ConserveZim after an inquiry.

Meanwhile, a source within the Ministry of Finance has revealed that the application to remove the 15% VAT was rejected.

“Letters have since been dispatched through the formal channels to this effect. If the Ministry of Lands and Agriculture has yet to receive this information, it is due to certain bottlenecks and bureaucratic challenges,” the source stated.

The source declined to specify the reasons for the application’s rejection.

A table showing a comparative production cost of fish in Zambia and Zimbabwe

If this rejection stands, it will effectively be the final nail on the coffin for Lake Harvest’s existence.

“Lake Harvest is currently facing a significant financial crisis due to severe cash flow constraints. These challenges are amplified by our inability to compete effectively with other meat products in the market that are exempt from VAT, making our fish expensive and uncompetitive. We are currently holding close to 100 tonnes of fish stocks, valued at approximately US$ 300,000,” Permit Shava revealed.